4 Hour MACD Forex Strategy

4H Macd 外汇交易策略

Translated by 叶知秋

Welcome to the 4 Hour MACD Forex Strategy. This strategy is aimed at simplicity as well as high probability trades. I have been in the equity market for almost ten years now and in the forex market for two years. I learned very early that forex trading is not for the shaky ones.One must have a tested and definite trading strategy as well as well organized discipline tofollow the strategy and execute the plan as to the letter. One must be exact and precise.

欢迎使用4 小时周期MACD外汇交易策略。这个策略是以高可靠性以及简单操作为目的设计的。我在资本市场呆了差不多外汇交易策略。这个策略是以高可靠性以及简单操作为目的设计的。我在资本市场呆了差不多10 年,外汇市场呆了2年。我很早就了解到外汇交易不是摇摆的人能交易的,外汇交易必须有明确的策略以及严格纪律来遵守这个策略和执行,交易者必须判断正确而且下手精确。

Therefore I paper traded for almost two years and read everything I could lay my handson. I bought books and courses. I attend a 5 day live web seminar. All this did not help me at allas it did not fit my style of personality and I just did not seem to connect with all this different strategies. Over two years of watching the graphs with different indicators, moving averages etc. I started to get a feeling for the movement and motion of the market especially the EurUsd around certain moving averages.

因此我读了2年的所有的几乎我能得到的有关交易的文章,我买回书籍和教程,我参加了5天网络在线研究会。发现所有的这些根本帮不上我,都不适合我,我看起来都不适合这些不同的交易策略。经过两年多的用不同的指标、移动均线等看图。对于市场运动和动量,特别是欧美围绕一特定移动平均运动,我开始有一些感觉。

It wasn’t till late last year that I discover a setting with the MACD that gives easy to read signals on a regular basis on a 4 hour timeframe. I like the 4 hour timeframe as one are not glued to the screen full time.

去年不是很迟的时候, 我发现一个MACD 设置可以在4H框架上容易的读到一些信号,我喜欢框架上容易的读到一些

信号,我喜欢4h 的时间框架,不需要总是盯着屏幕。

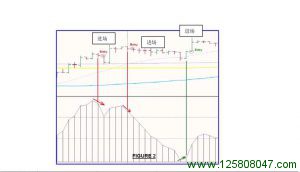

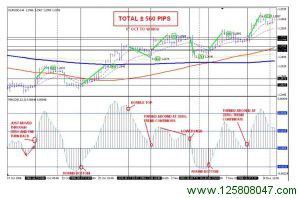

If you look at FIG 1 below you will see that there were 14 signals over a period of 5 weeks. Within that period of FIG 1 the signals given were pretty good. There are times when some signals does not produce positive results. I then had to work on a filter system to only let me take the best ones. I found that the MACD when moving in a certain way produces a 95% accuracy. I will show you later how the high probability trades look like.

如果您看一下下面的FIG 1 图,您会发现在5 周的时间内,有14 个信号发生。FIG 1中的给出的信号很漂亮,只有几次信号没有成功,我发现MACD信号有95%的正确滤,晚一点我会将看起来比较可靠的交易秀给您看。

In FIG 1 the signals are shown and FIG 2 shows that an entry is made after the 4 hour bar has closed and at the opening of the next bar.

FIG 1 标出了信号,FIG 2 给出了4 小时棒后及下一棒开始时给出的进出场点。

In FIG 3 another 19 deals were shown of which the last one was not finished yet so out of a total of 18 trades 5 were wrong and 13 were right.

FIG 3 给出了另外的19 个交易,最后一单没有完成,这样18 单交易5 个失败,13单正确。

As it is a 4 hour strategy it means sometimes setting the alarm clock to catch an entry in the early morning hours. What makes it nice is that one will know after the close of a 4 hour bar whether the next 4 hour bar might close as a signal by just following the MACD. Therefore one can set an alarm at that time.

Have a look at FIG 1 to 3.

4H图交易策略意味着有时候你可以设置一些报警,可以在早晨的时候去抓住一些进场机会。这多好,跟随MACD ,你知道需要4 小时棒收盘,是否需要下一个4小时棒收盘作为信号,这样你可以根据这设置一个闹钟提醒。

看看 FIG 1 到 3.

Disclaimer:

免责声明

As trading in the Forex market is very risky, the reader if going beyond this point and applying the concepts and methods describing in this document do so on his or her own will and risk. The writer and or anyone involved in the compiling of this document will not be held responsible for any losses incurred by using the methods described in this document as no money management nor stoploss levels are discussed as it vary from trader to trader according to there own risk and capital profiles.

由于外汇交易非常危险,读者如果按文章所描述的概念和交易方法交易,自行承担风险。文章所讨论的文相关的人都保留不承担依据此交易方法包括资金管理,止损设置水平因个人承受风险的能力和资产水平而异,作者和任何人与保留不承担由此带来损失的权利。

This was just to see and get a feeling for the graphs. Let us start to set-up our charts.

This was just to see and get a feeling for the graphs. Let us start to set-up our charts.

你看看这幅图有个感觉,我们可以开始设置一下图表了。

Moving Averages:

移动均线

First of all are the moving Averages that we are going to use. 首先你要用到是移动均线

1. 365 Exponential Moving Average (365EMA)

2. 200 Simple Moving Average (200SMA)

3. 89 Simple Moving Average (89SMA)

4. 21 Exponential Moving Average (21EMA)

5. 8 Exponential Moving Average (8EMA)

MACD settings at

MACD按此设置

1. Fast EMA 5

2. Slow EMA 13

3. MACD EMA 1

Horizontal Lines:

水平线

Three sets of horizontal lines above and below zero should be drawn on the MACD window at levels as well as one on zero

设置零上零下的几条水平线,在MACD窗口里,只要需要可以在0上拖过去。

1. Level +0.0015

2. Level +0.0030

3. Level +0.0045

4. Level –0.0015

5. Level –0.0030

6. Level –0.0045

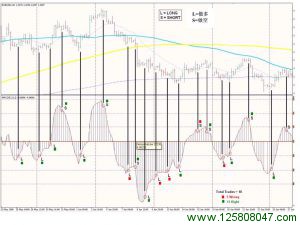

Your Graph should look like this: (Choose your own colour and styles)

设置好后,你的图看起来应该象这个样子:( 你可以自己选择颜色和线型) The MACD moves in certain patterns that when recognized can be very profitable trades. Let me show you the very important ones first. By not following every signal but only the ones that gives high probability trades through certain MACD patterns serves as a filter. The ones not familiar are not taken. This is the filter.

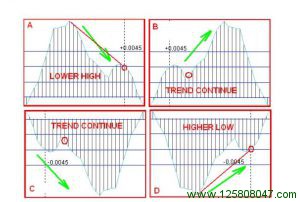

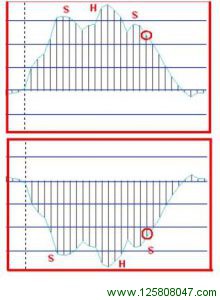

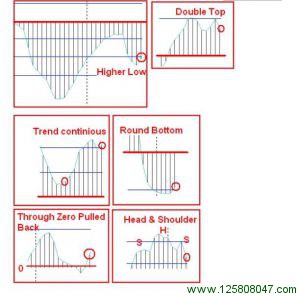

The MACD moves in certain patterns that when recognized can be very profitable trades. Let me show you the very important ones first. By not following every signal but only the ones that gives high probability trades through certain MACD patterns serves as a filter. The ones not familiar are not taken. This is the filter.

MACD 按特定的形态运动,识别MACD的特定图形就可以很好赚钱。让我首先给您看最重要的图形。不是下面的每个图形,但是不要根据每个MACD信号交易,除非这个信号给出高可靠的交易,通过特定的MACD 形态,MACD作为过滤器。不熟悉的不要做,这就是过滤。 This pattern comes very regular especially A and D as the MACD has moved beyond the 0.0045 level and are due for a correction and or trend reversal. B and C are trend continuing patterns and are entered in the direction of the trend. Red circles indicates entry signal and entry is made on the opening of the next bar.

This pattern comes very regular especially A and D as the MACD has moved beyond the 0.0045 level and are due for a correction and or trend reversal. B and C are trend continuing patterns and are entered in the direction of the trend. Red circles indicates entry signal and entry is made on the opening of the next bar.

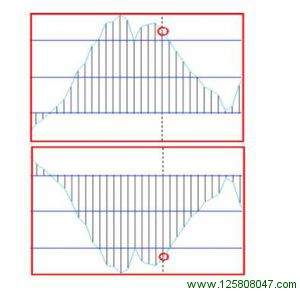

A和D,特别是MACD运动到超过0.0045后,由于趋势修正或趋势翻转,这两种形态在0.0045以上都经常出现。B和C是趋势继续型,按趋势的方向进入。红色的圆圈的进场信号标注的信号,在下一根K线开盘的时候进入。 The head and shoulder is another definite.头和肩是另一种明确的定义。

The head and shoulder is another definite.头和肩是另一种明确的定义。 Double top and bottom does not need any introduction as it speaks in any timeframe. 双头和双底不需要任何介绍了,任何框架内都有介绍。

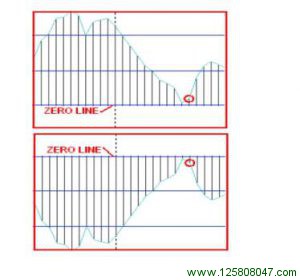

Double top and bottom does not need any introduction as it speaks in any timeframe. 双头和双底不需要任何介绍了,任何框架内都有介绍。 When the MACD comes down towards the Zero line and turn back up just above the Zero line it is normally a trend continuing and should be taken and are normally a strong move. 当 MACD 向 0 轴向下运动,然后

When the MACD comes down towards the Zero line and turn back up just above the Zero line it is normally a trend continuing and should be taken and are normally a strong move. 当 MACD 向 0 轴向下运动,然后

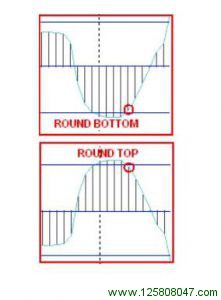

在 0 以上反向向上运动,通常是趋势继续,通常是一个强的运动。 Round tops and bottoms are for sure.Just be careful when within the first zone 0.0000 to 0.0015 above or below the zero. I like the rounding to be formed over at least 5 bars. 圆顶和圆底很确定, 当在第一区,在0-0.0015以上和0以下,要小心, 我喜欢至少5根以上棒形成的圆弧。

Round tops and bottoms are for sure.Just be careful when within the first zone 0.0000 to 0.0015 above or below the zero. I like the rounding to be formed over at least 5 bars. 圆顶和圆底很确定, 当在第一区,在0-0.0015以上和0以下,要小心, 我喜欢至少5根以上棒形成的圆弧。

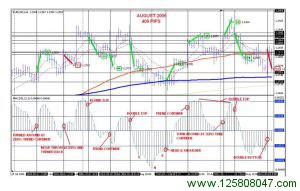

This was a difficult month (Jan 2007)up to now but already 190 Pips up and a great move is coming as the price is within a range for almost 8 days. Lets see if that will happen. 这是比较难的一个月(2007.1 ),到现在已经190多点了,价格在一定范围内,已经8 天了,让我们看看将会发生什么。

This was a difficult month (Jan 2007)up to now but already 190 Pips up and a great move is coming as the price is within a range for almost 8 days. Lets see if that will happen. 这是比较难的一个月(2007.1 ),到现在已经190多点了,价格在一定范围内,已经8 天了,让我们看看将会发生什么。

Up to now I have only concentrated to give the signal on the MACD window so that you will be able to recognize it. It is easy to see the formation after it has formed. It takes a bit of practice to recognize it while it is forming. Lets look at a couple just to see how they look when the trade is entered.

到现在为止,我仅仅集中介绍了MACD窗口给出的信号,你已经可以识别这些信号了吧,在这些形态形成的时候很容易识别他们,只需要一点点练习就可以在他们形成的时候识别他们。让我们看一对,当进场的时候怎么看他们。

Let us look at the graph above. See how price levels play a roll in the support and resistance of the price movement. Say we entered the trade at Entry above. Our first profit target will be around our fast moving averages (8EMA and 21EMA). Our second profit target will be around the slow moving averages(89SMA and365EMA). Our third profit target will be at price level 1.2100 etc etc etc. This is how you plan your trade in advance to take partial profits till you complete the trade. Should there be a moving average or price level nearby and below your entry level you must take note that the price might go and test them. So your stoploss must be aware of that.

Let us look at the graph above. See how price levels play a roll in the support and resistance of the price movement. Say we entered the trade at Entry above. Our first profit target will be around our fast moving averages (8EMA and 21EMA). Our second profit target will be around the slow moving averages(89SMA and365EMA). Our third profit target will be at price level 1.2100 etc etc etc. This is how you plan your trade in advance to take partial profits till you complete the trade. Should there be a moving average or price level nearby and below your entry level you must take note that the price might go and test them. So your stoploss must be aware of that.

让我们看看上你面的图形。看看价格支撑和阻力在价格运动中扮演什么觉角色。在上面的进场点进场,我们的第一目标是快移动均线左右(8EMA 和21EMA)。我们第二目标是慢移动均线左右(89 均线和365 均线)。我们第三目标是1.2100等等。这是你在兑现部分利润前预先要怎样计划你的交易,直到交易完成。你进场点附近的那条均线你必须注意,可能会测试,所以你的止损必须考虑到他们。

Again I ask you to study the movement of the price around the moving averages. When the price are above the 89SMA the trend is normally up and visa versa. After the price crosses the 89SMA it tends to pullback to the 21EMA before it carry on its direction if it is a trend direction change otherwise it tend to test the 89SMA again and then it runs over and across the 89SMA till it finds direction and then it pulls back to the 21EMA before proceeding on its path.

我再次要求你研究均线附近的价格运动,当价格在89均线之上,趋势一般向上,价格上穿均线之上,趋势一般向上,价格上穿89 均线后,在保持他原来趋势向上运动之前趋向折回21ema,如果这是一个趋势转变的话,否则趋向再次测试测试89 均线,然后在上穿89ema,直到他找到他的方向,在沿着他的方向运动之前又折回21ema 。

Here are a live trade I did for someone in explaining how I trade. This is actual e-mails that I did send. 25 January 2007 21:00 (GMT+2) 这是我给某个人解释我怎样交易一个实盘交易,这是我2007.1.25 21 :00寄出的真实

Here are a live trade I did for someone in explaining how I trade. This is actual e-mails that I did send. 25 January 2007 21:00 (GMT+2) 这是我给某个人解释我怎样交易一个实盘交易,这是我2007.1.25 21 :00寄出的真实

邮件。(GMT+2 )。

Hi

I took it with 30 pip stoploss and hope I can add to the Gbp one earlier this week.

你好,我设了 30 点的止损,我希望我可以在这周早些的时候可以加到 GBP The MACD pulled back to the Zero line and then closes lower which indicate a down move.MACD 拉回到0 线,然后收盘收在前低下面,意味着下跌开始。

The MACD pulled back to the Zero line and then closes lower which indicate a down move.MACD 拉回到0 线,然后收盘收在前低下面,意味着下跌开始。

“Got entry at 1.2955 and has set stoploss at breakeven at 1.2955 when price did hit 1.2935. I am scared for a false breakout below support but now the price can turnaround as I have a free ride.”

1 . 2955 进场,当价格没有碰到 1.2935 时 , 在突破处设置止损单, 我恐惧支撑下面的假突破,但现在价格翻

转了,我可以自由掌控了。 “Took 50% profit at 1.2920 and set other half stoploss at 1.2935”

“Took 50% profit at 1.2920 and set other half stoploss at 1.2935”

在 1.2920 位置兑现 50 %利润,另一半止损设到 1.2935

“Hi

Amazing how it found support with Fibonacci. I wanted to do this trade with you as it developed so that you can see how I go about. I just had a feeling that the price is not going to go down to 1.2900 straight away so I applied fibonacci as there was no other indicator between the entry price and 1.2900. One has to listen to that little voice inside as well. I was stopped out on the other have at 1.2935 so the total gain was 35 pips on 50% and 20 pips on the other 50% for a total of 27.5 pips on full lot. Not bad for an hour work.

Greetings”

你好!

费那滋回调线的支撑真神奇,我想和你一起来做这次交易,随着交易的发展,你可以看到我如何交易。我有感觉价格不会接跌向1.2900.所以我用费那滋回调线,因为在进场点到1.2900 之间没有其他指标.谁最好还是听一下一点声音,我止损出来了,另一个在1 。2935 ,这样在50 %时总个收入是35 点,另一个50 %时20 点,总共一手的收入是27.5。

这一个小时的工作不太差。

祝好!

This trade however was a bit risky as it was a breakout trade after ten days consolidation testing a trendline angling upwards. One has to evaluate the risk not only in terms of pips but also in terms of strategy and chart pattern. After a breakout the price very often turns back to test the breakout level and then that level becomes either support or resistance in this case it becomes Eur resistance.

这个交易仍然有点危险,因为是10天后一个钓鱼线测试向上趋势线的一个突破交易。谁最好先评估一下风险,不仅仅按点数,还应评估交易策略和形态。突破后,价格常常回测突破位置,然后这个突破的位置成为支撑或阻力,在这个例子中成为了欧元的阻力。

Stoploss have to be inside the breakout otherwise it can be triggered and then sometimes it can be very big before entry signal is given by the MACD.

止损需要设置在突破的内侧,否则会被触发交易,有时候会在MACD给出的进场信号之前很大。

Here is what I normally do when the MACD show s a signal but the stoploss are to big in relation to my capital or what I am comfortable with. I enter the trade in three stages with my stoploss set at the same level.

此时,我一般在MACD给出信号,但我觉得按我的资本不大或我觉得合适才做。我分三阶段进场我的止损设在同一水平。

I stopped counting the pips for the April 2006 testing as it completely convinced me of the success of this method. I randomly tested it using previous years and the results were amazing. Average of 300+ pips per month and then I only trade the trades that gives signals at these times 17:00, 21:00 and 01:00 (GMT +2). It gives between 8-10 deals per month using the mentioned timeframes.. (I use Metatrader and data supply by MIG.)

I stopped counting the pips for the April 2006 testing as it completely convinced me of the success of this method. I randomly tested it using previous years and the results were amazing. Average of 300+ pips per month and then I only trade the trades that gives signals at these times 17:00, 21:00 and 01:00 (GMT +2). It gives between 8-10 deals per month using the mentioned timeframes.. (I use Metatrader and data supply by MIG.)

我停止计算2006 年4月的盈利了,已经安全证明了我的方法是成功的。我用去年的数据随机测了一下,结果是惊人的。平均每月300 点以上上,只交易在17 :00 ,21 :00 和1 :00(GMT+2) 出现的信号,用这个时间框架每月交易8 -10 单。( 我用MIG 提供的MT数据)

If you use patterns in the MACD that occur regular that gives results and use them every time they occur you will most definitely make money.

如果你每次用MACD 规则形态交易,你将大多数确定赚钱。

I haven’t discuss nor used trendlines so far in this document and when you add them it will most definitely helps you in defining your exit levels. The entry level are determine by the MACD but the exit or profit levels is determine by support and resistance levels. I use the moving averages as described earlier as well as Fibonacci levels and then most definitely trendlines and price levels. I normally take the daily graph and draw the trendlines according to it and then go to the 4 hour graph. I make them nice and thick so that I can see them. Then I draw the different price levels such as 1.2900, 1.3000, 1.3100 etc. It is amazing to see how the price find support and or resistance at these levels.

在这篇文章里我迄今为止没有讨论和使用趋势线,一旦你添加他肯定可以帮助你找到出场点。进场点由MACD给出,但出场点和兑现利润由支撑和阻力线确定。我用早先描述的移动均线以及费那滋回调线确定,根据他们画趋势线,然后再回到4H 图,我将他们利用的很好,所以我们看到他们。 然后我画出象1.2900,1.3000,1.3100等等不同的水平线,很惊奇的能看到价格再这些水平线上找到支撑和阻力。

I hope that this document will help you on your way to financial independents.

我希望这篇文章可以在实现财务自由的路上帮到你。

感谢作者!感谢译者无私的奉献!

为了方便初学者,我已将设置保存成tpl模板,在附件下载后直接在MT4图表上面右键-加载模板-出来文件夹后将4HMACD.tpl文件复制粘贴进去,然后调用即可。

4HMACD(2020) (1.3 KB, 266 次)

4HMACD(2020) (1.3 KB, 266 次)

峰汇在线

峰汇在线